10 Simple Techniques For Property By Helander Llc

10 Simple Techniques For Property By Helander Llc

Blog Article

The Greatest Guide To Property By Helander Llc

Table of ContentsThe Facts About Property By Helander Llc RevealedThe Buzz on Property By Helander LlcThe Buzz on Property By Helander LlcGetting The Property By Helander Llc To WorkThe Basic Principles Of Property By Helander Llc The Greatest Guide To Property By Helander Llc

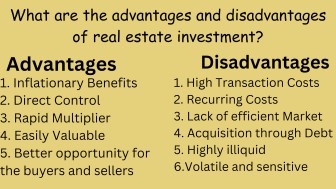

The benefits of investing in actual estate are various. Below's what you need to know about real estate advantages and why real estate is thought about an excellent financial investment.The advantages of buying realty consist of easy earnings, secure capital, tax advantages, diversification, and take advantage of. Realty financial investment counts on (REITs) offer a means to purchase real estate without having to possess, operate, or finance homes - (https://dc-washington.cataloxy.us/firms/www.propertybyhelander.com.htm). Capital is the internet earnings from a property financial investment after home mortgage settlements and general expenses have been made.

Oftentimes, capital only enhances with time as you pay down your mortgageand build up your equity. Genuine estate capitalists can make use of many tax breaks and reductions that can conserve money at tax obligation time. Generally, you can subtract the affordable costs of owning, operating, and managing a property.

Examine This Report on Property By Helander Llc

Realty worths have a tendency to enhance gradually, and with an excellent financial investment, you can turn a revenue when it's time to offer. Rents also often tend to increase in time, which can cause greater capital. This chart from the Reserve bank of St. Louis reveals mean home costs in the U.S

The locations shaded in grey show united state recessions. Typical Sales Cost of Homes Cost the USA. As you pay for a home mortgage, you construct equityan possession that belongs to your internet worth. And as you build equity, you have the utilize to get more properties and enhance capital and wealth much more.

Because actual estate is a tangible possession and one that can offer as security, funding is easily offered. Genuine estate returns vary, depending on elements such as area, possession class, and monitoring.

A Biased View of Property By Helander Llc

This, subsequently, converts into higher capital worths. Actual estate has a tendency to maintain the acquiring power of funding by passing some of the inflationary pressure on to renters and by integrating some of the inflationary pressure in the type of funding recognition. Home mortgage lending discrimination is unlawful. If you assume you have actually been victimized based upon race, faith, sex, marriage standing, use public help, national beginning, handicap, or age, there are steps you can take.

Indirect actual estate investing entails no straight ownership of a residential or commercial property or buildings. There are several ways that possessing real estate can shield versus rising cost of living.

Lastly, homes funded with a fixed-rate car loan will see the relative quantity of the monthly home loan payments drop over time-- for instance $1,000 a month as a set repayment will come to be much less challenging as rising cost of living deteriorates the purchasing power of that $1,000. Typically, a key home is not considered to be a real estate investment because it is used as one's home

The Buzz on Property By Helander Llc

Despite having the help of a broker, it can take a couple of weeks of job simply to find the ideal counterparty. Still, real estate is an unique possession class that's basic to recognize and can enhance the risk-and-return account of a capitalist's portfolio. By itself, realty offers capital, tax breaks, equity structure, affordable risk-adjusted returns, and a hedge versus rising cost of living.

Spending in real estate can be an incredibly rewarding and rewarding venture, but if you're like a lot of brand-new financiers, you might be wondering WHY you ought to be purchasing property and what advantages it brings over other financial investment opportunities. In enhancement to all the remarkable advantages that go along with buying property, there are some downsides you require to think about as well.

The Property By Helander Llc Diaries

If you're trying to find a way to get into the property market without needing to spend hundreds of hundreds of bucks, look into our residential properties. At BuyProperly, we use a fractional ownership version that enables capitalists to start with as little as $2500. One more significant advantage of property investing is the capability to make a high return from acquiring, refurbishing, and reselling (a.k.a.

The Property By Helander Llc Statements

For instance, if you are billing $2,000 rental fee per month and you incurred $1,500 in tax-deductible expenditures monthly, you will just be paying tax obligation on that $500 earnings per month. That's a big distinction from paying taxes on $2,000 monthly. The my blog revenue that you make on your rental system for the year is considered rental income and will be tired appropriately

Report this page